Supervised Learning I - K-Nearest Neighbors and Resampling Methods

Patrick PUN Chi Seng (NTU Sg)

References

Chapters 4.7.1, 4.7.6, 5.3 [ISLR2] An Introduction to Statistical Learning - with Applications in R (2nd Edition). Free access to download the book: https://www.statlearning.com/

To see the help file of a function funcname, type

?funcname.

K Nearest Neighbors (KNN)

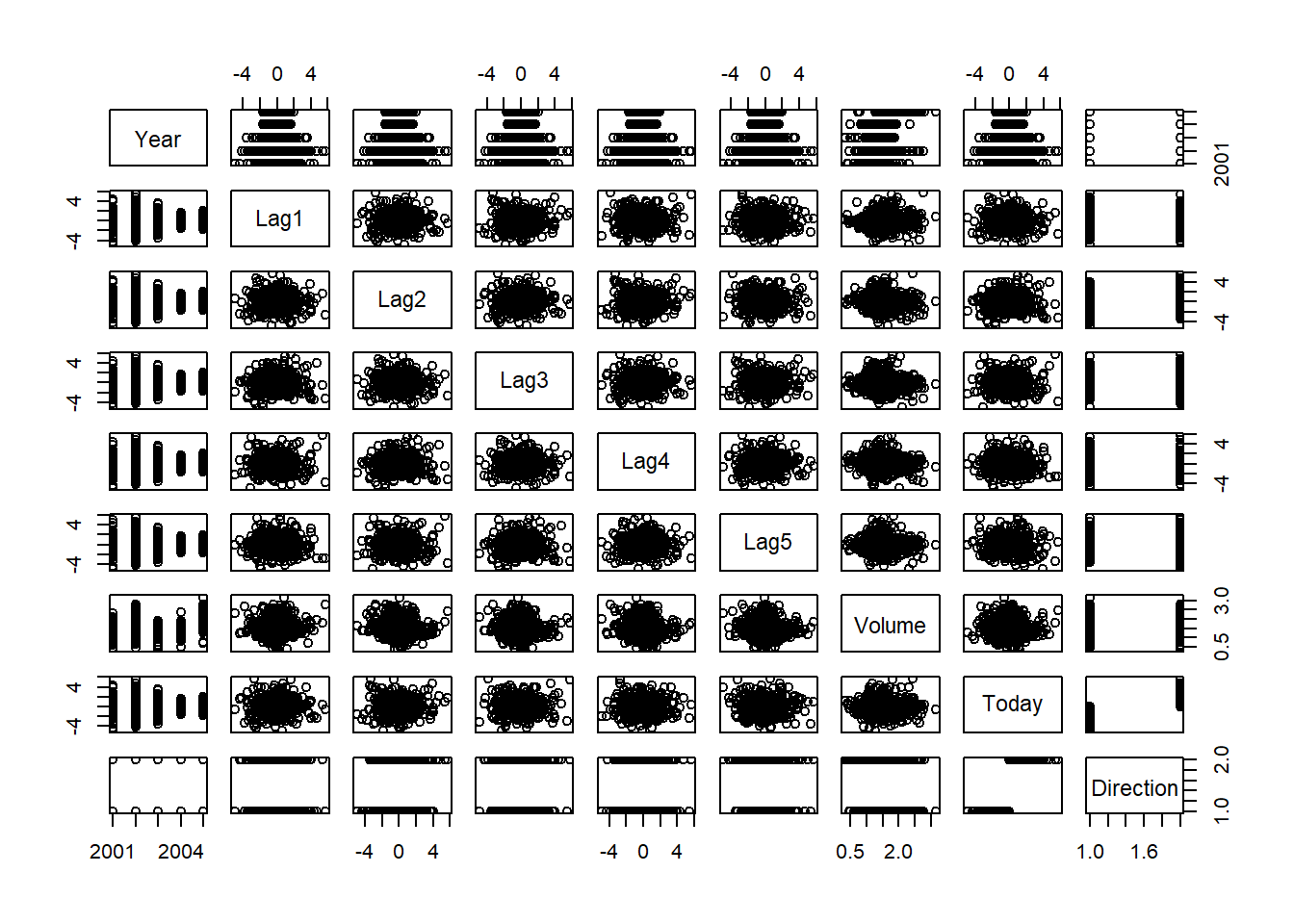

We will begin by examining some numerical and graphical summaries of

the Smarket data, which is part of the ISLR2

library. This data set consists of percentage returns for the S&P

500 stock index over \(1,250\) days,

from the beginning of 2001 until the end of 2005. For each date, we have

recorded the percentage returns for each of the five previous trading

days, lagone through lagfive. We have also

recorded volume (the number of shares traded on the

previous day, in billions), Today (the percentage return on

the date in question) and direction (whether the market was

Up or Down on this date). Our goal is to

predict direction (a qualitative response) using the other

features.

library(ISLR2)

names(Smarket)## [1] "Year" "Lag1" "Lag2" "Lag3" "Lag4" "Lag5"

## [7] "Volume" "Today" "Direction"dim(Smarket)## [1] 1250 9summary(Smarket)## Year Lag1 Lag2 Lag3

## Min. :2001 Min. :-4.922000 Min. :-4.922000 Min. :-4.922000

## 1st Qu.:2002 1st Qu.:-0.639500 1st Qu.:-0.639500 1st Qu.:-0.640000

## Median :2003 Median : 0.039000 Median : 0.039000 Median : 0.038500

## Mean :2003 Mean : 0.003834 Mean : 0.003919 Mean : 0.001716

## 3rd Qu.:2004 3rd Qu.: 0.596750 3rd Qu.: 0.596750 3rd Qu.: 0.596750

## Max. :2005 Max. : 5.733000 Max. : 5.733000 Max. : 5.733000

## Lag4 Lag5 Volume Today

## Min. :-4.922000 Min. :-4.92200 Min. :0.3561 Min. :-4.922000

## 1st Qu.:-0.640000 1st Qu.:-0.64000 1st Qu.:1.2574 1st Qu.:-0.639500

## Median : 0.038500 Median : 0.03850 Median :1.4229 Median : 0.038500

## Mean : 0.001636 Mean : 0.00561 Mean :1.4783 Mean : 0.003138

## 3rd Qu.: 0.596750 3rd Qu.: 0.59700 3rd Qu.:1.6417 3rd Qu.: 0.596750

## Max. : 5.733000 Max. : 5.73300 Max. :3.1525 Max. : 5.733000

## Direction

## Down:602

## Up :648

##

##

##

## pairs(Smarket)

The cor() function produces a matrix that contains all

of the pairwise correlations among the predictors in a data set. The

first command below gives an error message because the

direction variable is qualitative.

cor(Smarket)## Error in cor(Smarket): 'x' must be numericcor(Smarket[, -9])## Year Lag1 Lag2 Lag3 Lag4

## Year 1.00000000 0.029699649 0.030596422 0.033194581 0.035688718

## Lag1 0.02969965 1.000000000 -0.026294328 -0.010803402 -0.002985911

## Lag2 0.03059642 -0.026294328 1.000000000 -0.025896670 -0.010853533

## Lag3 0.03319458 -0.010803402 -0.025896670 1.000000000 -0.024051036

## Lag4 0.03568872 -0.002985911 -0.010853533 -0.024051036 1.000000000

## Lag5 0.02978799 -0.005674606 -0.003557949 -0.018808338 -0.027083641

## Volume 0.53900647 0.040909908 -0.043383215 -0.041823686 -0.048414246

## Today 0.03009523 -0.026155045 -0.010250033 -0.002447647 -0.006899527

## Lag5 Volume Today

## Year 0.029787995 0.53900647 0.030095229

## Lag1 -0.005674606 0.04090991 -0.026155045

## Lag2 -0.003557949 -0.04338321 -0.010250033

## Lag3 -0.018808338 -0.04182369 -0.002447647

## Lag4 -0.027083641 -0.04841425 -0.006899527

## Lag5 1.000000000 -0.02200231 -0.034860083

## Volume -0.022002315 1.00000000 0.014591823

## Today -0.034860083 0.01459182 1.000000000As one would expect, the correlations between the lag variables and

today’s returns are close to zero. In other words, there appears to be

little correlation between today’s returns and previous days’ returns.

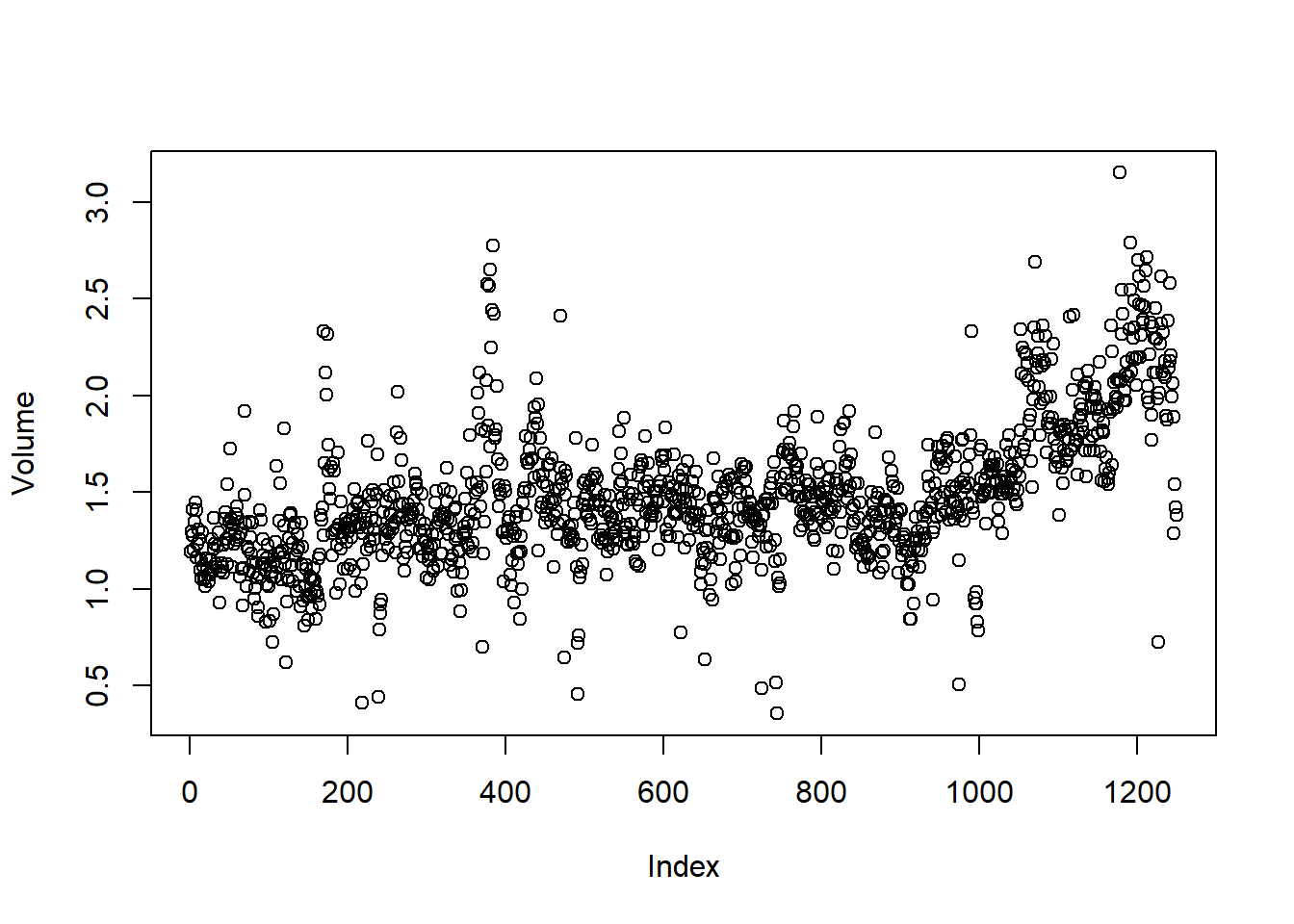

The only substantial correlation is between Year and

volume. By plotting the data, which is ordered

chronologically, we see that volume is increasing over

time. In other words, the average number of shares traded daily

increased from 2001 to 2005.

attach(Smarket)

plot(Volume)

We will now perform KNN using the knn() function, which

is part of the class library. knn() forms

predictions using a single command. The function requires four

inputs.

- A matrix containing the predictors associated with the training

data, labeled

train.Xbelow. - A matrix containing the predictors associated with the data for

which we wish to make predictions, labeled

test.Xbelow. - A vector containing the class labels for the training observations,

labeled

train.Directionbelow. - A value for \(K\), the number of nearest neighbors to be used by the classifier.

We use the cbind() function, short for column

bind, to bind the Lag1 and Lag2 variables

together into two matrices, one for the training set and the other for

the test set.

library(class)

train <- (Year < 2005)

data <- cbind(Lag1, Lag2)

train.X <- data[train,]

test.X <- data[!train,]

train.Direction <- Direction[train]

test.Direction <- Direction[!train]Now the knn() function can be used to predict the

market’s movement for the dates in 2005. We set a random seed before we

apply knn() because if several observations are tied as

nearest neighbors, then R will randomly break the tie.

Therefore, a seed must be set in order to ensure reproducibility of

results.

set.seed(1)

knn.pred <- knn(train.X, test.X, train.Direction, k = 1)

table(knn.pred, test.Direction)## test.Direction

## knn.pred Down Up

## Down 43 58

## Up 68 83mean(knn.pred == test.Direction)## [1] 0.5The results using \(K=1\) are not very good, since only \(50\) % of the observations are correctly predicted. Of course, it may be that \(K=1\) results in an overly flexible fit to the data. Below, we repeat the analysis using \(K=3\).

set.seed(1)

knn.pred <- knn(train = train.X, test = test.X, cl = train.Direction, k = 3)

table(knn.pred, test.Direction)## test.Direction

## knn.pred Down Up

## Down 48 55

## Up 63 86mean(knn.pred == test.Direction)## [1] 0.531746# Compare the performance of K=1 and K=3.The results have improved slightly. But increasing \(K\) further turns out to provide no further improvements.

KNN does not perform well on the Smarket data but it

does often provide impressive results. As an example we will apply the

KNN approach to the Insurance data set, which is part of

the ISLR2 library. This data set includes \(85\) predictors that measure demographic

characteristics for 5,822 individuals. The response variable is

Purchase, which indicates whether or not a given individual

purchases a caravan insurance policy. In this data set, only \(6\) % of people purchased caravan

insurance.

dim(Caravan)## [1] 5822 86attach(Caravan)

summary(Purchase)## No Yes

## 5474 348348 / 5822## [1] 0.05977327Because the KNN classifier predicts the class of a given test

observation by identifying the observations that are nearest to it, the

scale of the variables matters. Variables that are on a large scale will

have a much larger effect on the distance between the

observations, and hence on the KNN classifier, than variables that are

on a small scale. For instance, imagine a data set that contains two

variables, salary and age (measured in dollars

and years, respectively). As far as KNN is concerned, a difference of

\(\$1,000\) in salary is enormous

compared to a difference of \(50\)

years in age. Consequently, salary will drive the KNN

classification results, and age will have almost no effect.

This is contrary to our intuition that a salary difference of \(\$1,000\) is quite small compared to an age

difference of \(50\) years.

Furthermore, the importance of scale to the KNN classifier leads to

another issue: if we measured salary in Japanese yen, or if

we measured age in minutes, then we’d get quite different

classification results from what we get if these two variables are

measured in dollars and years.

A good way to handle this problem is to standardize the data

so that all variables are given a mean of zero and a standard deviation

of one. Then all variables will be on a comparable scale. The

scale() function does just this. In standardizing the data,

we exclude column \(86\), because that

is the qualitative Purchase variable.

Note that we cannot standardize the whole dataset and then split it into training and test data, because it leads to test data leakage to training data. We now first split the observations into a test set, containing the first 1,000 observations, and a training set, containing the remaining observations. Then we standardize the data with training data features’ means and standard deviations. We fit a KNN model on the training data using \(K=1\), and evaluate its performance on the test data.

test <- 1:1000

train.X <- Caravan[-test, -86]

test.X <- Caravan[test,-86]

train.X <- scale(train.X)

train_means <- attr(train.X,"scaled:center")

train_sds <- attr(train.X, "scaled:scale")

test.X <- scale(test.X, train_means, train_sds)

train.Y <- Purchase[-test]

test.Y <- Purchase[test]

set.seed(1)

knn.pred <- knn(train.X, test.X, train.Y, k = 1)

mean(test.Y != knn.pred)## [1] 0.117mean(test.Y != "No")## [1] 0.059The vector test is numeric, with values from \(1\) through \(1,000\). Typing

Caravan[test, -86] yields the submatrix of the data

containing the observations whose indices range from \(1\) to \(1,000\), whereas typing

Caravan[-test, -86] yields the submatrix containing the

observations whose indices do not range from \(1\) to \(1,000\). The KNN error rate on the 1,000

test observations is just under \(12\)

%. At first glance, this may appear to be fairly good. However, since

only \(6\) % of customers purchased

insurance, we could get the error rate down to \(6\) % by always predicting No

regardless of the values of the predictors!

Suppose that there is some non-trivial cost to trying to sell insurance to a given individual. For instance, perhaps a salesperson must visit each potential customer. If the company tries to sell insurance to a random selection of customers, then the success rate will be only \(6\) %, which may be far too low given the costs involved. Instead, the company would like to try to sell insurance only to customers who are likely to buy it. So the overall error rate is not of interest. Instead, the fraction of individuals that are correctly predicted to buy insurance is of interest.

It turns out that KNN with \(K=1\) does far better than random guessing among the customers that are predicted to buy insurance. Among \(77\) such customers, \(9\), or \(11.7\) %, actually do purchase insurance. This is double the rate that one would obtain from random guessing.

table(knn.pred, test.Y)## test.Y

## knn.pred No Yes

## No 874 50

## Yes 67 99 / (67 + 9)## [1] 0.1184211Using \(K=3\), the success rate increases to \(23.1\) %, and with \(K=5\) the rate is also \(23.1\) %. This is over four times the rate that results from random guessing. It appears that KNN is finding some real patterns in a difficult data set!

knn.pred <- knn(train.X, test.X, train.Y, k = 3)

table(knn.pred, test.Y)## test.Y

## knn.pred No Yes

## No 921 53

## Yes 20 66 / 26## [1] 0.2307692knn.pred <- knn(train.X, test.X, train.Y, k = 5)

table(knn.pred, test.Y)## test.Y

## knn.pred No Yes

## No 931 56

## Yes 10 33 / 13## [1] 0.2307692However, while this strategy is cost-effective, it is worth noting that only 13 customers are predicted to purchase insurance using KNN with \(K=5\). In practice, the insurance company may wish to expend resources on convincing more than just 13 potential customers to buy insurance.

Resampling Methods

In practice, we often need to evaluate model performance and choose

the best model among candidates. Resampling methods provide tools for

estimating the test error, which helps us avoid overfitting and improves

generalization. We illustrate these methods using the

Smarket dataset with KNN classification, and later with

bootstrap and (over/under)sampling examples.

train <- (Year < 2005)

data <- cbind(Lag1, Lag2)

train.X <- data[train,]

test.X <- data[!train,]

train.Direction <- Direction[train]

test.Direction <- Direction[!train]Validation-set Approach

The validation-set approach involves splitting the available data into two parts: a training set and a validation (test) set. The model is trained on the training set and evaluated on the validation set.

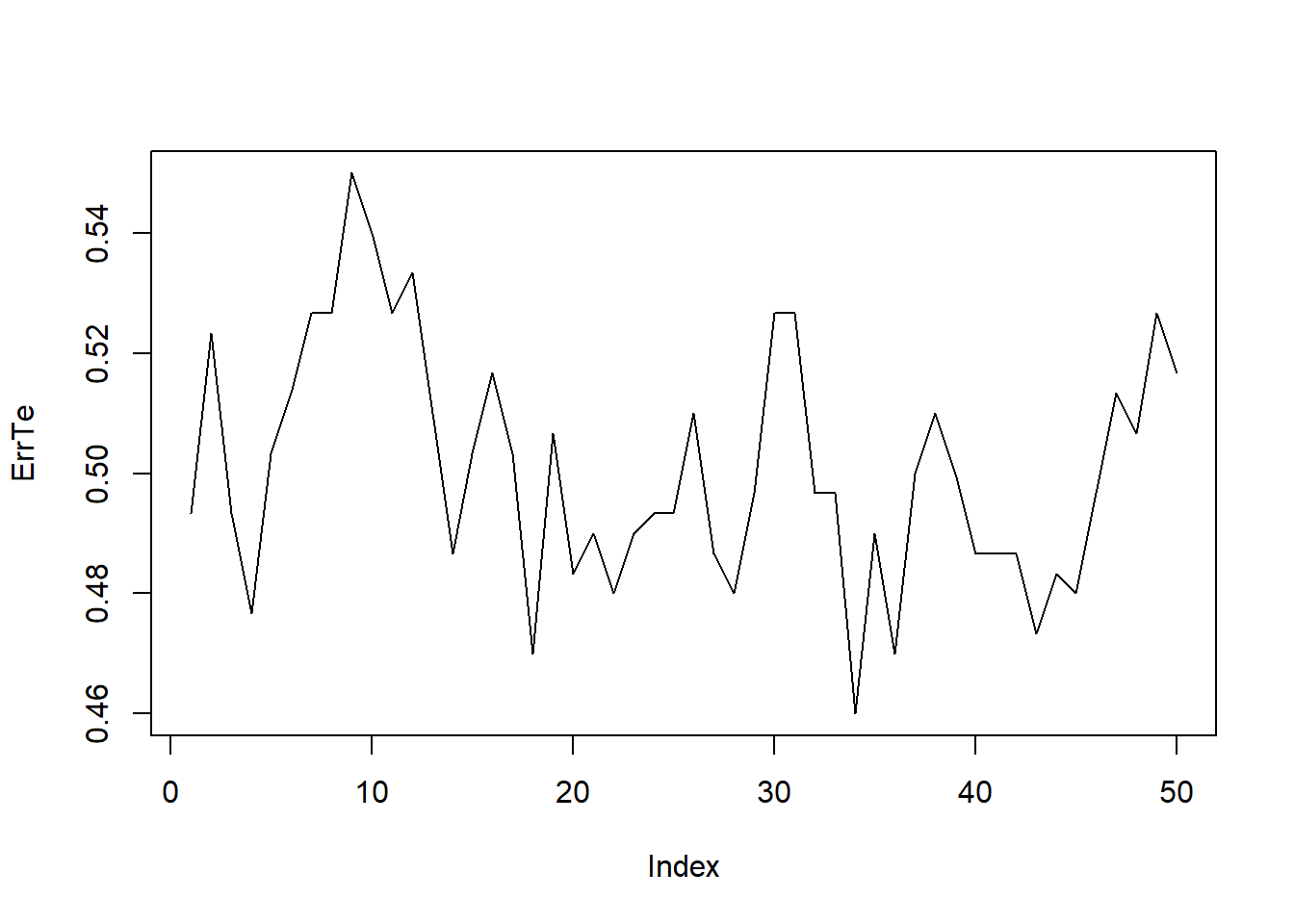

In the following code, we randomly select 70% of the data for training and use the remaining 30% for testing. We then compute test error rates for different values of k in KNN.

set.seed(1)

ntrain=nrow(train.X)

pdtrainind <- sample(ntrain, 0.7*ntrain)

pdtrain.X <- train.X[pdtrainind,]

pdtest.X <- train.X[-pdtrainind,]

pdtrain.Direction <- train.Direction[pdtrainind]

pdtest.Direction <- train.Direction[-pdtrainind]

ErrTe=0; Kmax=50

for(k in 1:Kmax){

knn.pred <- knn(train = pdtrain.X, test = pdtest.X, cl = pdtrain.Direction, k = k)

ErrTe[k]=mean(knn.pred != pdtest.Direction)

}

plot(ErrTe,type="l")

which.min(ErrTe)## [1] 34The plot shows how the error rate changes with k. The which.min(ErrTe) function returns the value of k with the lowest validation error. Repeating the split with a different random seed may give a different “optimal” k, showing that the validation-set approach can be unstable.

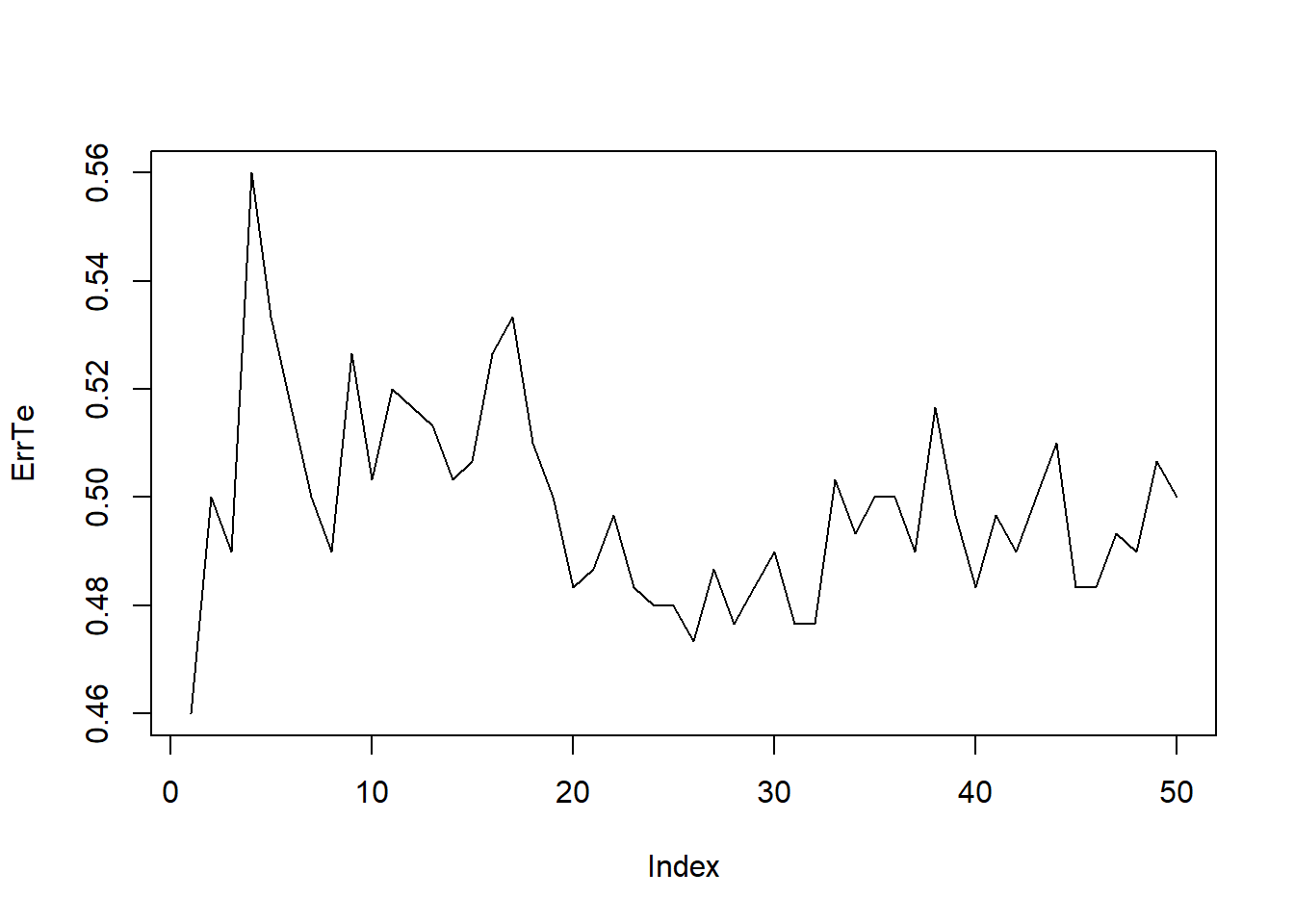

set.seed(2)

ntrain=nrow(train.X)

pdtrainind <- sample(ntrain, 0.7*ntrain)

pdtrain.X <- train.X[pdtrainind,]

pdtest.X <- train.X[-pdtrainind,]

pdtrain.Direction <- train.Direction[pdtrainind]

pdtest.Direction <- train.Direction[-pdtrainind]

ErrTe=0; Kmax=50

for(k in 1:Kmax){

knn.pred <- knn(train = pdtrain.X, test = pdtest.X, cl = pdtrain.Direction, k = k)

ErrTe[k]=mean(knn.pred != pdtest.Direction)

}

plot(ErrTe,type="l")

which.min(ErrTe)## [1] 1F-fold cross Validation

To obtain a more reliable estimate, we can use k-fold cross validation. The data is split into F roughly equal parts (“folds”). Each fold is used once as a validation set, while the other folds form the training set. The test errors are averaged across folds.

Here, we use 10-fold cross validation:

F <- 10

set.seed(1)

folds <- cut(seq(1,ntrain), breaks = F, labels = FALSE)

folds <- folds[sample(ntrain)]

folds## [1] 9 7 2 10 6 5 3 3 10 2 4 6 3 9 10 5 4 8 9 6 8 1 2 8 9

## [26] 5 7 9 10 4 7 10 9 9 10 4 10 6 5 2 5 10 6 6 6 9 4 6 2 1

## [51] 7 6 4 3 2 4 1 5 9 4 3 7 6 7 1 5 1 8 8 2 4 5 2 10 8

## [76] 5 9 7 7 9 5 6 9 10 2 4 8 2 1 9 1 2 3 8 7 4 6 6 7 3

## [101] 7 2 4 5 9 9 7 5 9 9 7 6 5 8 2 4 1 10 3 7 10 9 3 2 5

## [126] 3 7 1 6 8 6 3 6 7 3 10 8 4 4 7 1 1 10 6 10 8 7 3 3 6

## [151] 4 5 1 5 4 7 4 9 9 1 4 9 3 5 8 9 9 3 8 3 2 10 10 4 5

## [176] 9 6 5 4 2 10 1 9 4 10 2 1 3 7 2 1 3 5 6 5 7 5 8 6 1

## [201] 10 8 7 7 7 2 8 6 8 10 3 5 5 2 2 10 6 10 9 3 10 6 6 9 6

## [226] 5 4 8 2 7 1 6 4 5 9 10 4 8 5 2 8 5 9 6 4 4 1 9 5 2

## [251] 9 8 5 8 9 7 3 5 10 1 6 6 1 8 3 1 10 7 1 4 9 9 7 9 7

## [276] 1 6 1 9 2 8 6 3 4 8 3 1 8 3 10 9 3 1 8 5 8 9 3 2 8

## [301] 10 3 4 7 6 9 6 5 3 4 4 8 9 6 2 7 10 9 8 7 5 2 3 5 10

## [326] 3 6 8 2 1 7 5 4 2 10 2 5 5 5 2 9 10 3 7 9 7 9 9 7 1

## [351] 1 1 5 9 10 8 5 10 1 2 2 4 5 10 3 1 5 5 2 6 2 7 5 6 9

## [376] 3 7 10 7 8 2 8 2 6 9 8 6 10 8 1 2 6 5 9 2 10 8 7 10 7

## [401] 1 6 10 7 7 1 7 4 9 5 10 6 7 6 8 6 8 10 10 8 4 3 1 10 10

## [426] 1 2 7 1 7 1 5 7 3 10 2 1 8 10 8 4 3 2 4 5 2 6 4 2 5

## [451] 5 8 4 10 9 2 9 5 2 6 4 8 10 2 1 3 3 2 8 7 4 2 8 3 2

## [476] 6 4 1 5 1 6 2 8 6 10 10 4 2 5 1 3 4 4 3 6 4 3 10 3 9

## [501] 1 8 8 7 4 7 3 6 4 1 7 1 4 10 6 9 4 10 7 7 3 2 1 7 3

## [526] 8 10 1 4 2 5 3 4 4 1 5 5 8 5 7 3 3 1 2 6 8 3 4 3 1

## [551] 10 9 6 3 8 3 9 5 3 10 9 6 5 9 7 3 3 8 10 4 1 2 6 1 4

## [576] 7 9 5 2 4 9 4 1 2 10 3 3 8 5 10 5 4 7 2 1 2 8 5 5 8

## [601] 9 9 10 3 5 10 8 6 3 4 5 3 2 1 4 1 2 6 10 1 7 9 8 5 4

## [626] 6 6 4 7 4 3 4 7 5 1 5 10 1 1 8 3 4 5 10 10 4 8 3 9 4

## [651] 10 10 7 8 6 1 8 9 7 8 10 3 7 9 8 9 5 5 10 1 5 10 3 1 6

## [676] 5 4 5 1 5 9 8 1 1 9 4 6 9 3 8 2 8 2 4 3 4 8 8 4 10

## [701] 6 1 6 6 8 5 7 8 3 4 2 5 10 10 1 6 8 6 6 6 3 4 3 6 1

## [726] 7 6 2 4 7 1 3 10 2 9 7 4 8 2 7 9 9 9 10 4 9 2 3 8 10

## [751] 2 3 7 5 6 7 3 10 2 3 9 7 6 4 5 2 10 2 5 6 10 9 1 9 8

## [776] 8 8 1 4 7 3 7 6 5 1 1 1 9 1 3 7 9 7 8 8 5 7 8 6 7

## [801] 9 5 5 9 4 7 4 4 8 6 9 10 9 8 2 3 10 7 1 7 3 10 8 7 2

## [826] 5 4 1 10 4 3 6 9 10 5 1 10 7 1 1 2 6 7 4 2 4 8 8 2 8

## [851] 1 2 2 5 2 2 8 6 10 5 7 1 9 3 8 2 2 1 9 4 3 5 1 6 3

## [876] 6 4 3 2 7 2 3 2 7 3 1 10 7 1 4 1 6 9 5 3 9 6 2 1 3

## [901] 4 6 6 4 3 8 4 7 10 5 8 6 3 5 2 6 10 5 6 9 3 5 1 8 3

## [926] 3 8 7 7 4 3 1 9 10 2 4 8 7 7 10 6 2 10 8 8 6 4 9 9 1

## [951] 5 10 2 1 9 8 10 7 8 6 10 7 2 2 5 4 2 1 2 6 10 10 1 9 6

## [976] 9 2 6 9 7 6 3 5 9 7 1 3 3 6 1 2 7 5 10 9 4 9 2We then compute the error rates for k=1,…,50 and average across folds:

Kmax=50

ErrCV <- matrix(0, nrow=F, ncol=Kmax)

for (f in 1:F) {

# Pseudo train-test split

pdtrainind <- which(folds != f)

pdtrain.X <- train.X[pdtrainind,]

pdtest.X <- train.X[-pdtrainind,]

pdtrain.Direction <- train.Direction[pdtrainind]

pdtest.Direction <- train.Direction[-pdtrainind]

for(k in 1:Kmax){

# Model fitting

knn.pred <- knn(train = pdtrain.X, test = pdtest.X, cl = pdtrain.Direction, k = k)

# Error

ErrCV[f,k]=mean(knn.pred != pdtest.Direction)

}

}

CV <- apply(ErrCV, 2, mean)

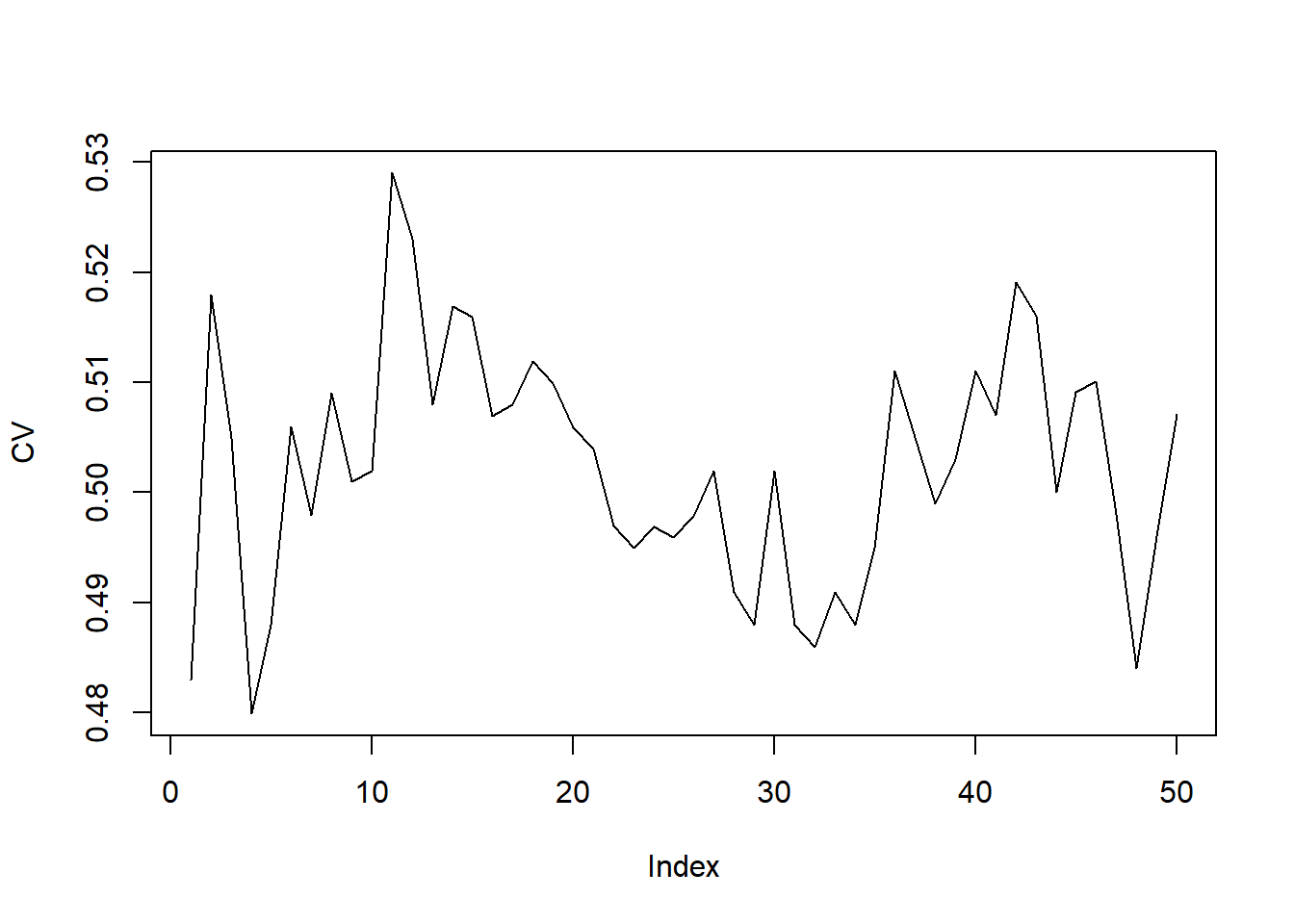

plot(CV,type="l")

which.min(CV)## [1] 4The resulting plot typically shows a smoother curve than the

validation-set approach. The which.min(CV) gives the best

choice of k.

Bootstrap

Bootstrap is another powerful resampling technique. Instead of splitting data into folds, we generate many bootstrap datasets by sampling with replacement from the training set. Each bootstrap dataset is the same size as the original, but contains duplicate observations. This allows us to estimate variability of a statistic or model parameter.

Create one bootstrap dataset:

BSind<-sample(ntrain,replace=TRUE)

BSdata<-train.X[BSind,]Generate multiple bootstrap datasets using a

for-loop:

B=100

for(b in 1:B){

BSind<-sample(ntrain,replace=TRUE)

BSdata<-train.X[BSind,]

# ...perform analyses...

# ...store the results indexed by b...

}Bootstrap is particularly useful for estimating the standard error of model parameters when no analytical formula is available.

Oversampling and Undersampling

In imbalanced classification problems, where one class is much rarer than the other, resampling techniques can create a more balanced dataset.

We illustrate this with a subset of the iris dataset containing only setosa (majority) and versicolor (minority).

irisdata<-iris[1:75,]

irisdata$Species <- factor(irisdata$Species)

n<-nrow(irisdata)

majorind=(1:n)[irisdata[,5]=="setosa"]

minorind=(1:n)[irisdata[,5]=="versicolor"]

majorn=length(majorind)

minorn=length(minorind)Oversampling duplicates minority-class samples until class sizes are equal.

OSind=sample(minorind,majorn-minorn,replace=TRUE)

OSdata<-rbind(irisdata,irisdata[OSind,])

table(irisdata$Species)##

## setosa versicolor

## 50 25table(OSdata$Species)##

## setosa versicolor

## 50 50Undersampling removes majority-class samples to match the minority-class size.

USind=sample(majorind,majorn-minorn,replace=FALSE)

USdata<-irisdata[-USind,]

table(irisdata$Species)##

## setosa versicolor

## 50 25table(USdata$Species)##

## setosa versicolor

## 25 25Note. Oversampling can increase the risk of overfitting (by repeating minority examples), while undersampling may discard useful information from the majority class.

SMOTE (Synthetic Minority Oversampling Technique)

In imbalanced classification problems, simply duplicating minority-class examples (oversampling) can lead to overfitting, while discarding majority-class examples (undersampling) may waste information. The SMOTE provides an alternative by generating synthetic minority observations. These new samples are created by interpolating between existing minority-class observations and their nearest neighbors.

We illustrate SMOTE using the smotefamily package on an

imbalanced version of the iris dataset, where setosa is the

majority and versicolor is the minority class.

# install.packages("smotefamily")

library(smotefamily)

# Convert to numeric labels for smotefamily

x <- irisdata[,1:4]

y <- as.numeric(irisdata$Species) # setosa=1, versicolor=2

# Apply SMOTE

set.seed(1)

iris.SMOTE <- SMOTE(x, y, K=5, dup_size=2)

table(y) # original distribution## y

## 1 2

## 50 25table(iris.SMOTE$data$class) # after SMOTE##

## 1 2

## 50 75Here: dup_size = 2 roughly doubles the minority class by

generating synthetic examples.

K = 5 specifies the number of nearest neighbors used

when interpolating new synthetic points.

The table() commands show how the class distribution

becomes more balanced after SMOTE.

Note. SMOTE creates more diverse samples than random oversampling, but if the classes overlap significantly, synthetic points may fall into ambiguous regions. Careful use of SMOTE is recommended when decision boundaries are not well-separated.